Exploring Cloned Credit Cards: Implications for Businesses and Consumers

The digital age has brought countless conveniences, including fast transactions and easy access to credit. However, with advancements in technology come risks, particularly in the realm of financial security. One such risk is the cloned credit card, an issue that affects both businesses and consumers alike.

What is a Cloned Credit Card?

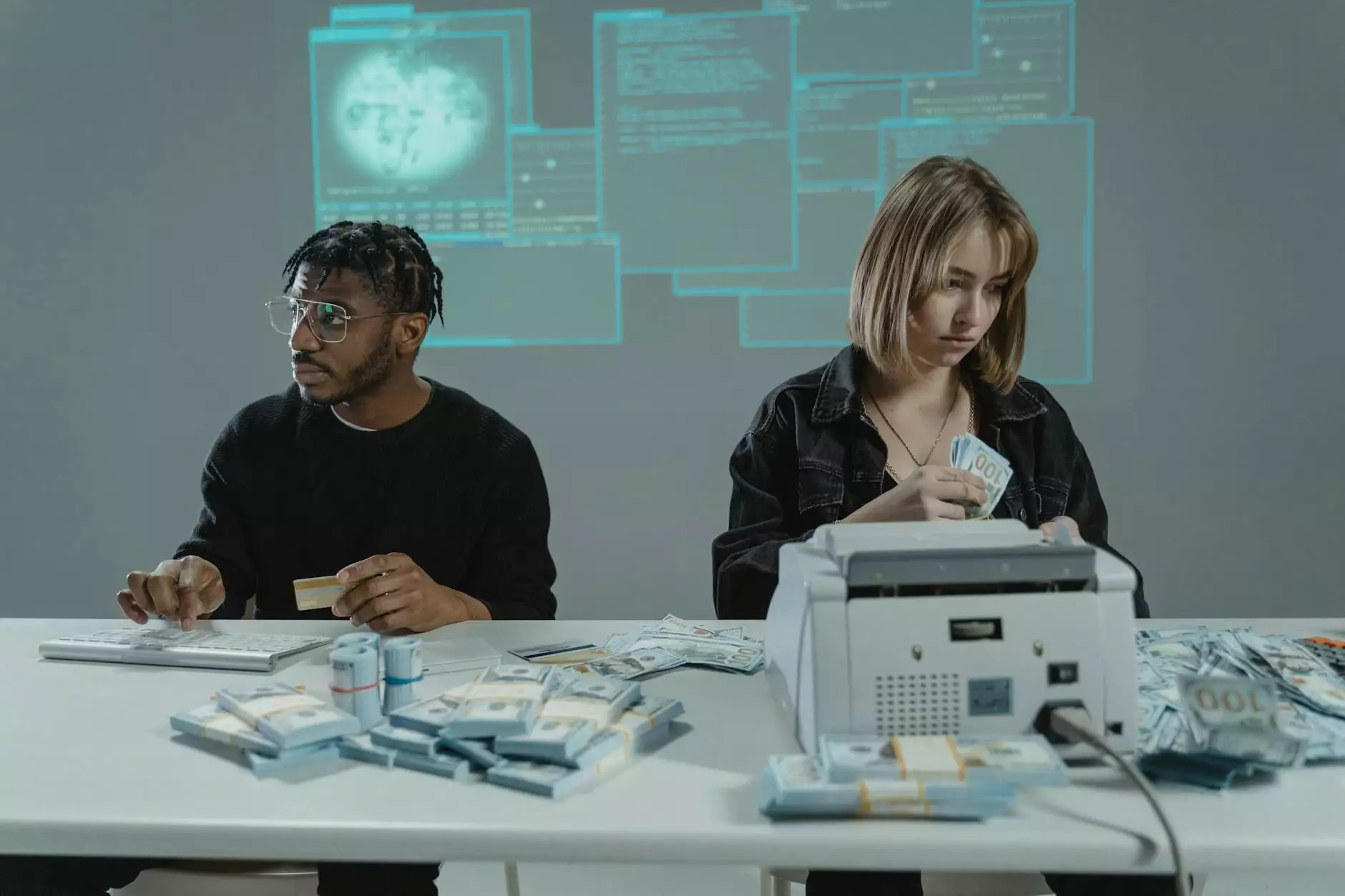

A cloned credit card refers to a credit card that has been illegally reproduced or duplicated, usually through the use of sophisticated technology. This fraudulent method allows individuals to impersonate the original cardholder and engage in unauthorized transactions. Cloning typically involves stealing personal information through various means, such as data breaches, phishing, or skimming devices.

The Process of Credit Card Cloning

Understanding how credit cards are cloned is crucial to preventing such incidents. Here are the main steps involved in the credit card cloning process:

- Data Theft: Criminals often employ skimming devices placed on ATMs or point-of-sale terminals. These devices capture the information stored on the card's magnetic stripe.

- Card Duplication: Once the data is obtained, thieves can use this information to create a cloned card, often using readily available equipment and software.

- Transactions: The cloned card can then be used to make purchases or withdrawals, often without the original cardholder noticing until it’s too late.

How Cloned Credit Cards Affect Businesses

The impact of cloned credit cards extends beyond individual victims. Businesses, especially retailers and e-commerce platforms, face severe repercussions:

- Financial Loss: Businesses can suffer significant losses due to chargebacks from fraudulent transactions made with cloned cards.

- Reputation Damage: A company’s reputation can be significantly tarnished if customers learn they have been victimized by a security breach involving cloned cards.

- Increased Security Costs: Businesses must invest in security measures to protect customer data, which can strain financial resources.

The Battle Against Cloned Credit Cards

To combat the growing threat of cloned credit cards, businesses and consumers alike must adopt best practices. Here are several effective strategies:

For Businesses

- Implement EMV Technology: The migration to EMV chip technology has significantly reduced the cloning of physical cards. Businesses should ensure their card readers are updated accordingly.

- Monitor Transactions: Companies should regularly review transaction histories for irregular patterns that may indicate fraud.

- Staff Training: Training employees to recognize fraud tactics can empower them to take preventive actions.

For Consumers

- Regularly Review Statements: Consumers should frequently check their bank statements and report any suspicious activities immediately.

- Use Secure Transactions: When shopping online, consumers should look for secure websites (look for HTTPS) and use credit over debit cards when possible.

- Keep Personal Information Private: Avoid sharing sensitive information that could potentially be used for credit card cloning.

The Connection Between Cloned Cards and Counterfeit Money

In many ways, the world of cloned credit cards parallels the circulations of fake banknotes and counterfeit money. Both represent serious threats to financial systems and consumer trust.

Counterfeiters often use cloned cards as part of their broader schemes to launder money made from illicit activities. This intertwining leads to increased challenges for law enforcement and financial institutions.

Legal Framework and Protection Against Cloning

In response to the threats posed by cloned cards and counterfeit money, many countries have enacted laws and regulations aimed at strengthening consumer protection. Here are some key points to understand:

- Liability Protections: Many credit card issuers offer zero-liability policies, meaning that consumers are not held responsible for unauthorized transactions made with cloned cards.

- Fraud Monitoring Services: Financial institutions are increasingly offering services that monitor accounts for suspicious activities, alerting consumers to potential fraud before significant damage is done.

- Collaboration with Law Enforcement: Banks and credit card companies often collaborate with law enforcement to combat fraud through intelligence sharing and reporting schemes.

The Future of Payment Security

As technology continues to evolve, so do the methods used by fraudsters. The future of payment security will likely include innovations aimed specifically at combating cloned credit cards:

- Biometric Security: Incorporating fingerprints or facial recognition can add an extra layer of security to card transactions.

- Tokenization: This technology replaces sensitive card information with unique identifiers that are useless if intercepted.

- Blockchain Technology: Some companies are exploring blockchain solutions for secure transactions, potentially minimizing the risk of fraudulent cloning.

Conclusion

Understanding the implications of cloned credit cards is vital for consumers and businesses alike. With the right knowledge and protective measures, individuals can safeguard their financial information, while businesses can protect themselves from the damaging effects of credit card fraud.

By staying informed and adopting best practices, we can collectively mitigate the risks associated with cloned cards and counterfeit money, ensuring a safer and more secure environment for all financial transactions.

Additional Resources

To further educate yourself on combating credit card fraud and understanding the nuances of counterfeit money, consider exploring the following resources:

- Federal Trade Commission's Guide on Credit

- IdentityTheft.gov for Reporting Fraud

- CreditCards.com for Fraud Prevention Tips

For inquiries regarding fake banknotes, counterfeit money, or cloned credit card scams, visit variablebills.com.